China produces a large amount of gypsum as

by-product during industrial production. However, the utilization rate is low.

Solutions to increase the utilization rate include developing new utilization

modes because at present, by-product gypsum is mainly used to produce

construction materials. Also, the concession policy should be expanded to cover

companies that do not possess the capability to further process industrial

by-product gypsum.

China produces a large amount of gypsum as

a by-product during industrial production. The statistics from the Gypsum

Association of China Building Materials Federation (GAC) reveal that about 180

million tonnes of desulfurized gypsum and phosphogypsum are generated by the

thermal power industry, the steel industry and the phosphate fertilizer

industry every year. Desulfurized gypsum and phosphogypsum take up 85% of the

total amount of industrial by-product gypsum. As of the end of 2013,

accumulatively about 400 million tonnes of phosphogypsum and 180 million tonnes

of desulfurized gypsum have built up. This industrial by-product is usually

used to produce cement retarder, plasterboard and other products.

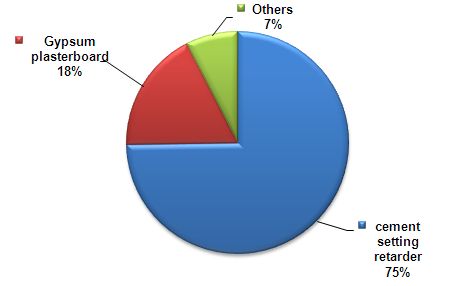

Main applications of gypsum in China

Source: GAC & CCM

It is also worth noting that the average

utilization rate of overall gypsum is under 50%, with phosphogypsum ranking the

bottom. According to GAC's data for 2013, only 27.4% of phosphogypsum was

utilized in 2013.

As CCM has summarized, the following aspects

contribute to the current low utilization rate of gypsum.

Firstly, the government's concession policy

is not extensive. The large number of chemical plants and power plants which do

not have the capability to further process gypsum are unable to access the

value-added tax concession when they simply process gypsum into plaster powder

for selling. As a consequence, they do not have any incentive to recycle the

by-products.

The Catalogue of Resources for

Comprehensive Utilization Entitling Enterprises to Income Tax Preferences

(2008) which came into effect from 1 Jan., 2008 establishes that the income tax

is calculated on the basis of 90% of the total revenue of the year of

production. The income tax applies to the production of bricks (tiles), blocks,

wallboards, gypsum products and commercial fly ashes with more than 70% coal

gangue, fly ash, desulfurized gypsum or phosphogypsum as the raw material.

In addition, according to the relating

stipulations of the Notice about Policies regarding the Value Added Tax on

Products Made through Comprehensive Utilization of Resources and Other

Products, which was jointly issued by the Ministry of Finance and State

Administration of Taxation in 2008, selling specified construction products

made from raw materials with at least 30% waste residues including

phosphogypsum and sulfurgypsum can enjoy the exemption to the value-added tax

payment. Cement clinkers produced with rotary kiln technology and raw materials

that contain no less than 30% waste residues including phosphogypsum and

sulfurgypsum can enjoy the immediate value-added tax refund policy. Finally,

new wall materials including gypsum blocks, hollow core slabs and plasterboards

which are made from phosphogypsum can enjoy the immediate 50% value-added tax

refund policy.

Secondly, the increases to the treatment

cost places gypsum in a disadvantageous position in the market. Yang Zaiying,

the Secretary General of GAC, says that by-product gypsum, especially

phosphogypsum, contains deleterious substances like sulphur and fluorine, which

needs pre-processing for the development of high quality new construction

materials. Its comprehensive utilization requires a large amount of technical

transformation capital from enterprises, and this raised the cost of gypsum

utilization indirectly. Besides, although the production of phosphogypsum in

Hubei, Yunnan, Guizhou, Shandong and Anhui provinces occupied 78% of the total

production volume in China, the companies which are located in Yunnan Province

or Guizhou Province are quite remote and are far away from their consumer

markets, resulting in a continuously low gypsum comprehensive utilization rate.

Thirdly, the current narrow utilization

range of gypsum is another negative factor. In terms of the utilization of

industrial by-product gypsum, the gypsum product that people are familiar with

is only useful for low price construction materials such as construction used

plaster powder, plasterboards or gypsum blocks. However, large enterprises

avoid these materials because of the low profits. In contrast, gypsum mold is a

profitable gypsum product, but only a limited amount is used. However, it has

attracted an increasing number of manufacturers, leading to a severe

duplication of products and gradual market saturation.

CCM believes that focus should be on the

following aspects in order to improve the utilization of industrial by-product

gypsum.

It is important to maintain the current

utilization mode and to develop new modes. The Secretary General of GAC, Yang

Zaiing, once said the demand for gypsum had been rising with the increasing

production amount of cement in China. The rapid development of real estate

results in the increasing demand for construction materials including cement,

gypsum and ceramics. President Tang of Jiangsu Efful New Material Science and

Technology Co., Ltd. indicated that 80% of American residences used gypsum

products as partition materials, and gypsum blocks took up over 40% of the

inner wall market in western European countries like Germany and France. Thus,

there are promising prospects for industrial by-product gypsum utilization in

China.

Currently, the utilization of industrial

by-product gypsum is still relatively onefold, with focus being laid on

construction materials. New utilization modes therefore need to be developed.

Professor Ying of No.1 Industrial Design Institute of Jiangsu Province pointed

out that the utilization of gypsum should move beyond the existing mode of

"gypsum equals to construction material" and new technologies need to

be adopted to improve the utilization of industrial by-product gypsum. New

modes and technologies are necessary to achieve larger profits and the large

scale utilization and industrial development of by-product gypsum. Examples of

new modes include the production of high value-added chemical products such as

gypsum whiskers.

Another step is to expand the concession

range covered by the government's policy. The current concession policy

excludes many companies that have no capability to further process industrial

by-product gypsum. These companies have little choice but to abandon the

utilization of industrial by-product gypsum because of the higher production

costs.

Director Wang of Technology Committee of

the National Environmental Protection and Resourceful Utilization of Industrial

By-product Gypsum Program Technology (Nanjing) Center indicated that

restrictions on the mining of natural gypsum needed to be imposed in accordance

with the law in extensive production regions of industrial by-product gypsum.

Also, the costs of natural gypsum mining and the build up of industrial

by-product gypsum must be increased in order to improve the recycling of

industrial by-product gypsum.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in

touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.